Andrew Haughwout on Urban Land Values

Thanks to Andrew Haughwout from the Federal Reserve Bank of New York for leading this week’s brown bag discussion on measuring and interpreting urban land values.

Haughwout’s research uses the COMPS dataset from the CoStar Group to identify two types of transactions: purchases of vacant land and purchases of parcels with structures that the buyer intends to tear down. By examining these transactions, Haughwout effectively hones in on the price of the land itself.

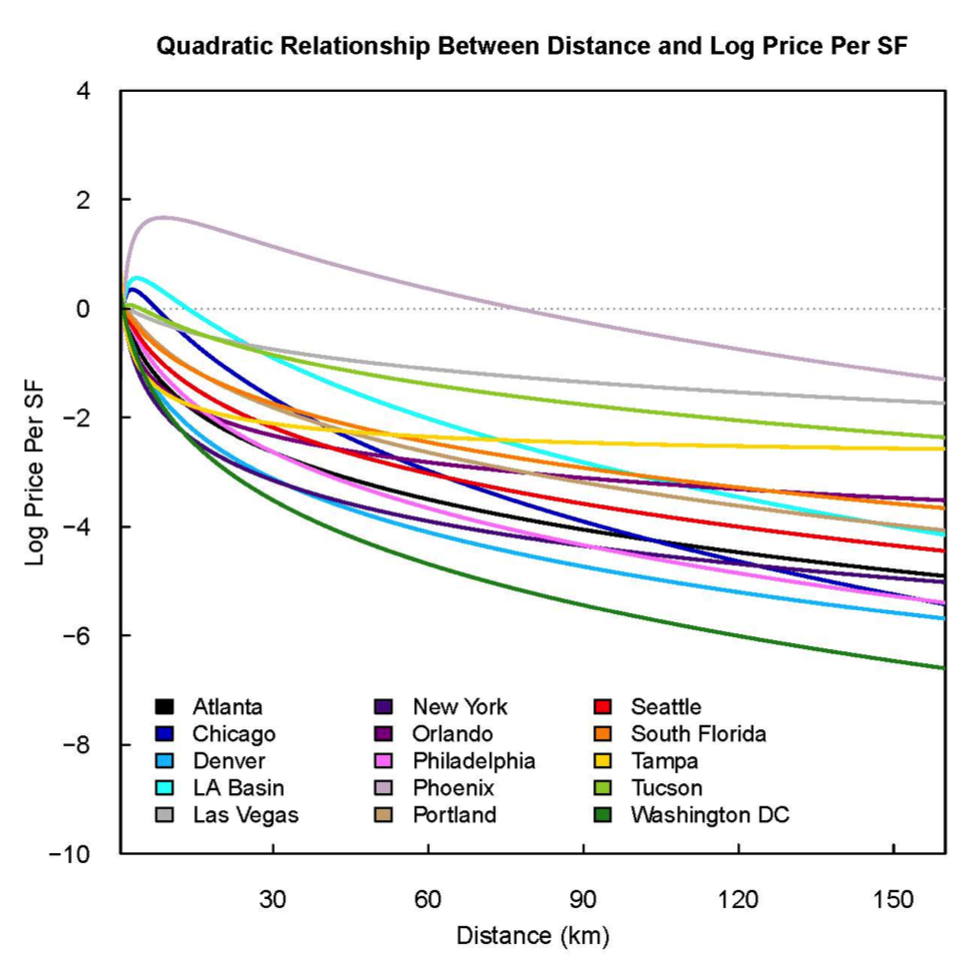

Among other results, Haughwout finds a quadratic relationship between distance of a parcel from the city center and the log price per square foot. The relationship, with the most expensive land nearest the city center, is consistent across cities though the gradient is less steep in some cities than others.

By developing a better understanding of land values, Haughwout’s work opens up the possibility of, among other things, helping to detect real estate bubbles, judging the impact of policy interventions, and providing information for more efficient property taxation.

Speakers

Andy Haughwout is a Vice President in the Research and Statistics Group. He is the Group's Senior Administrative Officer and a co-editor of the Liberty Street Economics blog. In addition to his duties at the Bank, he serves on a Transportation Research Board panel investigating the value of transportation spending as economic stimulus. He is a past Chair of the North American Regional Science Council and the Federal Reserve System Committee on Regional Analysis and serves on the Advisory Board of the Journal of Regional Science. Prior to joining the New York Fed, Mr. Haughwout served as Assistant Professor at Princeton University. He holds a BA from Swarthmore College and a PhD from the University of Pennsylvania. See more here.

Please fill out the information below to receive our e-newsletter(s).

*Indicates required.